Is It Better To Buy Now or Wait for Lower Mortgage Rates? Here’s the Tradeoff

Market Report Michael Smith August 15, 2025

Market Report Michael Smith August 15, 2025

Mortgage rates continue to be one of the hottest topics in our local real estate conversations — and for good reason. After a weaker-than-expected jobs report earlier this month, the bond market reacted quickly. The result? In early August, average mortgage rates dropped to their lowest point of 2025 so far — about 6.55%.

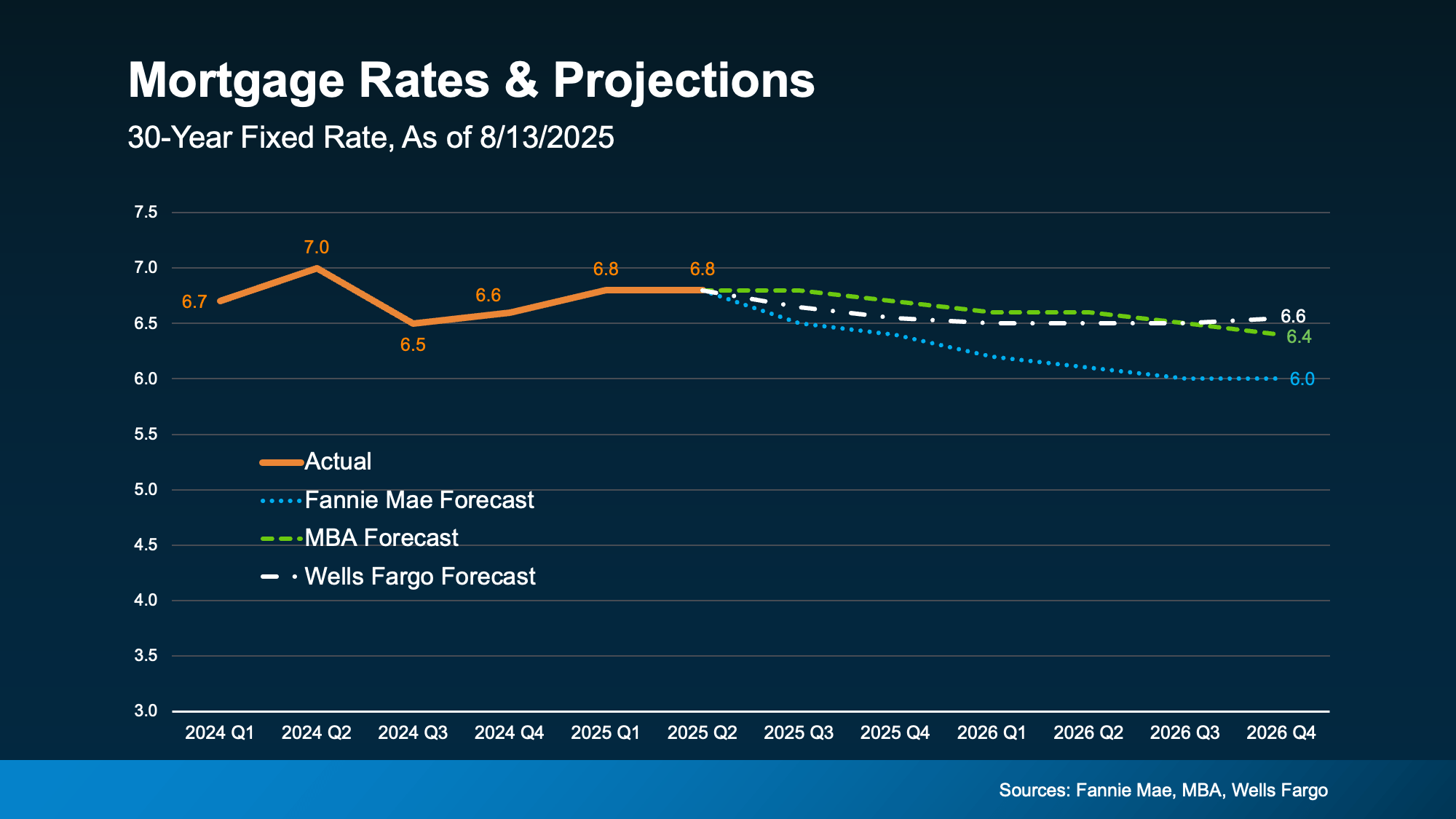

According to the latest forecasts, rates aren’t expected to fall dramatically anytime soon. Most experts project they’ll stay somewhere in the mid-to-low 6% range through 2026 (see graph below):

In other words, no big changes are expected. But small shifts, like the one we just saw, are still likely.

In other words, no big changes are expected. But small shifts, like the one we just saw, are still likely.

Each time there’s changing economic news, there’s a chance mortgage rates will react. And with so many reports coming out this week, we’ll get a better feeling of where the economy and inflation are headed – and how rates will respond.

The magic number most buyers seem to be watching for is 6%. And it’s not just a psychological benchmark; it has real impact. A recent report from the National Association of Realtors (NAR) says if rates reach 6%:

That’s a lot of pent-up demand just waiting for the green light. And if you look back at the graph above, you’ll see Fannie Mae thinks we’ll hit that threshold next year. That raises an important question: Does it really make sense to wait for lower rates?

Because here’s the tradeoff. If you’re waiting for 6%, you need to realize a lot of other people are too. And when rates do continue to inch down and more buyers jump into the market all at once, you could face more competition, fewer choices, and higher home prices. NAR explains it like this:

"Home buyers wishing for lower mortgage interest rates may eventually get their wish, but for now, they’ll have to decide whether it’s better to wait or jump into the market."

Consider the unique window that exists right now:

These are all opportunities that will go away if rates fall and demand surges. That’s why NAR says:

"Buyers who are holding out for lower mortgage rates may be missing a key opening in the market."

Rates aren't expected to hit 6% this year. But when they do, you’ll have to deal with more competition as other buyers jump back in. If you want less pressure and more negotiating power, that opportunity is already here – and it might not last for long. It all depends on what happens in the economy next.

Let’s talk about what’s happening in our area and whether it makes sense to make your move now, before everyone else does.

Market Report

February 14, 2026

Affordability

January 26, 2026

Home Prices

December 11, 2025

Economy

November 6, 2025

Mortgage Rates

September 15, 2025

The Fed Doesn’t Directly Set Mortgage Ratescreate

Market Report

August 15, 2025

Home Prices

July 17, 2025

Market Report

June 19, 2025

After years of it feeling almost impossible to find a home you want to buy, things are changing for the better.

Market Report

May 1, 2025

Understanding How Past Recessions Have Shaped the Housing Market and What It Means for You Today

We pride ourselves in providing personalized solutions that bring our clients closer to their dream properties and enhance their long-term wealth. Contact us today to find out how we can be of assistance to you!