The Housing Market Is Turning a Corner Going into 2026

Home Prices Michael Smith December 11, 2025

Home Prices Michael Smith December 11, 2025

After several years of high mortgage rates and hesitation from buyers, momentum is quietly building beneath the surface of the housing market. Sellers are reappearing. Buyers are re-engaging. And for the first time in what feels like forever, there’s movement happening again.

No, it’s not a surge. But it is a shift – and it’s one that could set the stage for a stronger year in 2026.

So, what’s driving the comeback? Here are three big trends that are slowly breathing life back into the housing market right now.

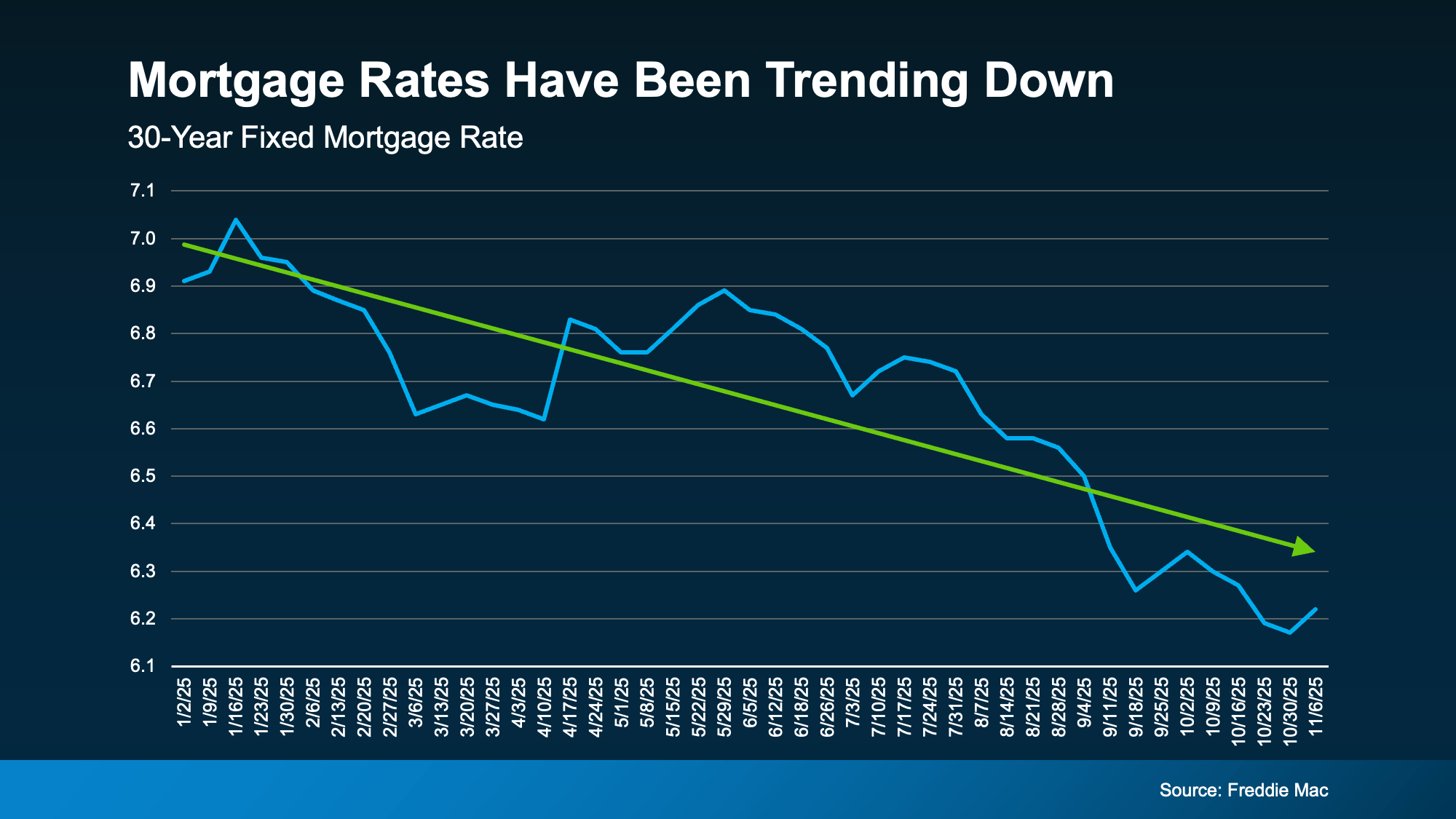

Mortgage rates are always going to have their ups and downs – that's just how rates work. Especially with the general economic uncertainty right now, some volatility is to be expected. But, if you zoom out, it’s the larger trend that really matters most.

And overall, rates have been trending down for most of this year (see graph below):

And in just the last few months, we’ve seen the best rates of 2025. According to Sam Khater, Chief Economist at Freddie Mac:

And in just the last few months, we’ve seen the best rates of 2025. According to Sam Khater, Chief Economist at Freddie Mac:

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

Here's why that matters for you. This shift changes what you can actually afford. It means lower borrowing costs and more buying power. Take this as an example.

Data from Redfin shows a buyer with a $3,000 monthly budget can now afford roughly $25,000 more home than they could one year ago. That’s a big deal. And it’s just one of the reasons why activity is picking up.

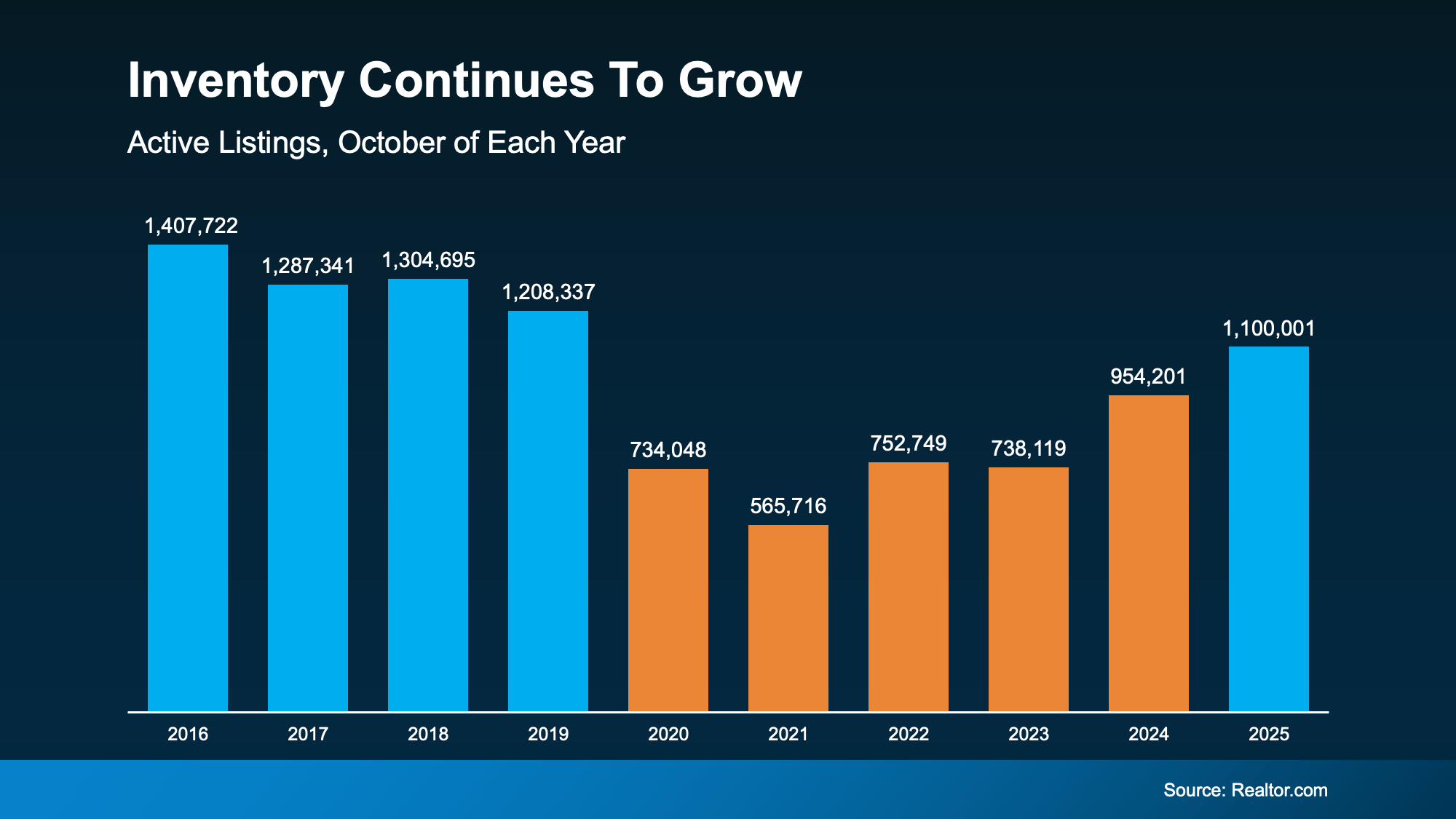

For a while, many homeowners stayed put because they didn’t want to give up their low mortgage rate. That “lock-in effect” kept inventory tight. And while plenty of homeowners are still staying where they are today, the number of rate-locked homeowners is starting to ease as rates come down. Life changes are becoming a bigger part of what’s driving more people to move, and that’s opening up more inventory.

Data from Realtor.com shows just how much the number of homes for sale has grown. And the really interesting part is that the market is approaching levels that haven’t been seen for the past six years (see the blue on the graph below):

That return to more normal inventory levels is a really good thing. It gives buyers more options than they’ve had in years. And it’s helping to bring the market closer to balance.

That return to more normal inventory levels is a really good thing. It gives buyers more options than they’ve had in years. And it’s helping to bring the market closer to balance.

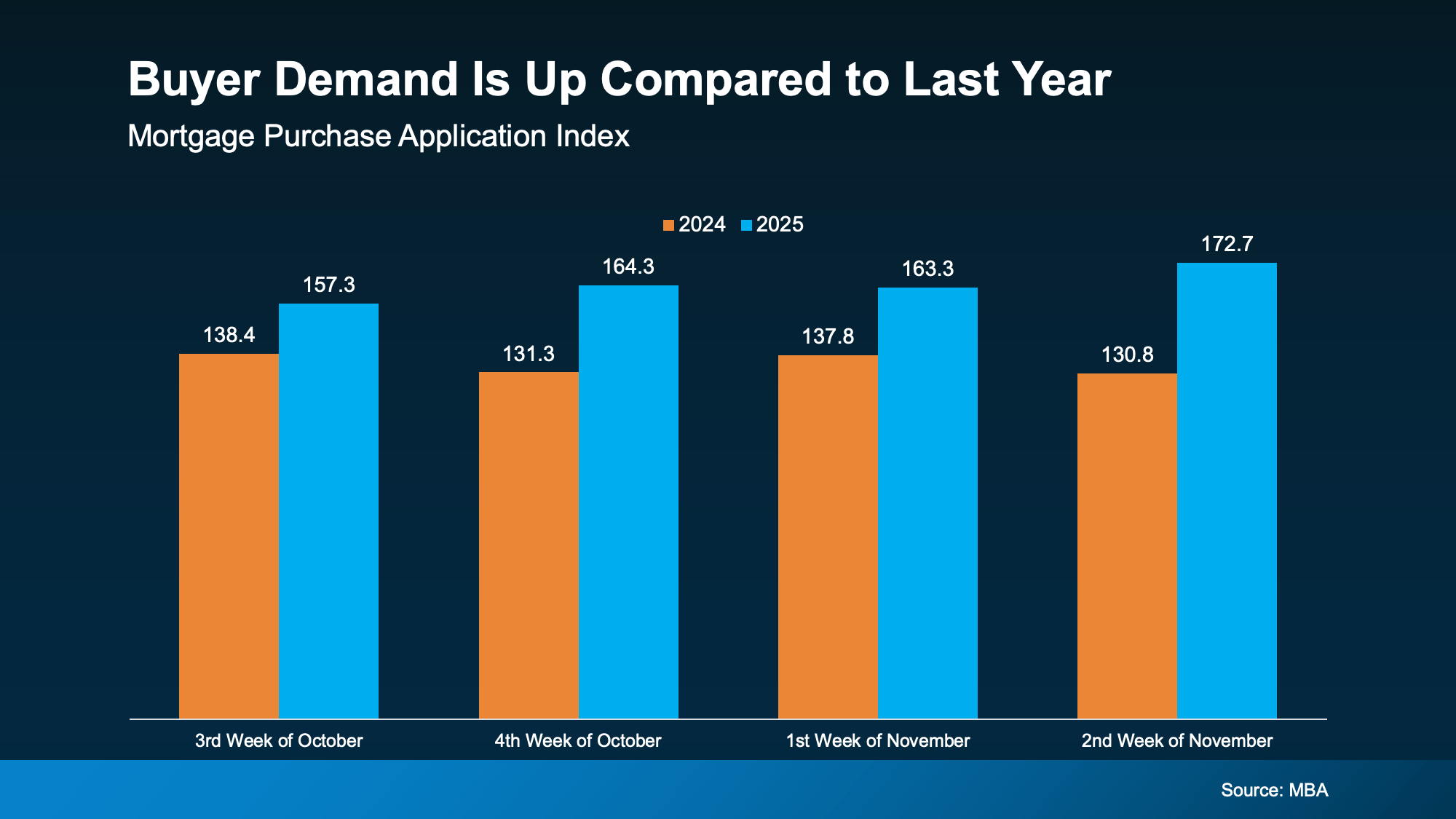

And it’s not just sellers making moves. With more options and slightly better affordability, buyers are getting back in the game, too. The Mortgage Bankers Association (MBA) reports purchase applications are up compared to last year, a clear signal that demand is building again (see graph below):

And experts think this momentum will continue. Economists from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) all forecast moderate sales growth going into 2026.

And experts think this momentum will continue. Economists from Fannie Mae, the Mortgage Bankers Association (MBA), and the National Association of Realtors (NAR) all forecast moderate sales growth going into 2026.

Now, this recovery won’t happen overnight. It’s not a flood of activity. But it is the start of steady improvement going into 2026. And that's something a lot of people have been waiting for.

After several slower-than-normal years, the market is finally starting to turn a corner. Declining mortgage rates, more listings, and growing buyer activity all point to a market gaining real traction.

Market Report

February 14, 2026

Affordability

January 26, 2026

Home Prices

December 11, 2025

Economy

November 6, 2025

Mortgage Rates

September 15, 2025

The Fed Doesn’t Directly Set Mortgage Ratescreate

Market Report

August 15, 2025

Home Prices

July 17, 2025

Market Report

June 19, 2025

After years of it feeling almost impossible to find a home you want to buy, things are changing for the better.

Market Report

May 1, 2025

Understanding How Past Recessions Have Shaped the Housing Market and What It Means for You Today

We pride ourselves in providing personalized solutions that bring our clients closer to their dream properties and enhance their long-term wealth. Contact us today to find out how we can be of assistance to you!